🌆 Eight-Building, 50-Unit Rental Portfolio in Baltimore – Cash-Flowing & Turnkey! 💰

Seize this rare chance to own a fully occupied, cash-flowing portfolio of 50 units across eight buildings in the heart of Baltimore, Maryland. With an 88% occupancy rate and $53,773 in monthly rental income, this turnkey investment delivers immediate cash flow and long-term growth potential in a high-demand rental market. 📈

Why This Portfolio Stands Out:

- Proven Cash Flow: Generates $645,276 annually in rental income, offering a strong cap rate of ~7.5% and growing (based on current financials). 💵

- Turnkey & Stable: 88% occupancy with long-term tenants ensures consistent returns from day one. 🔒

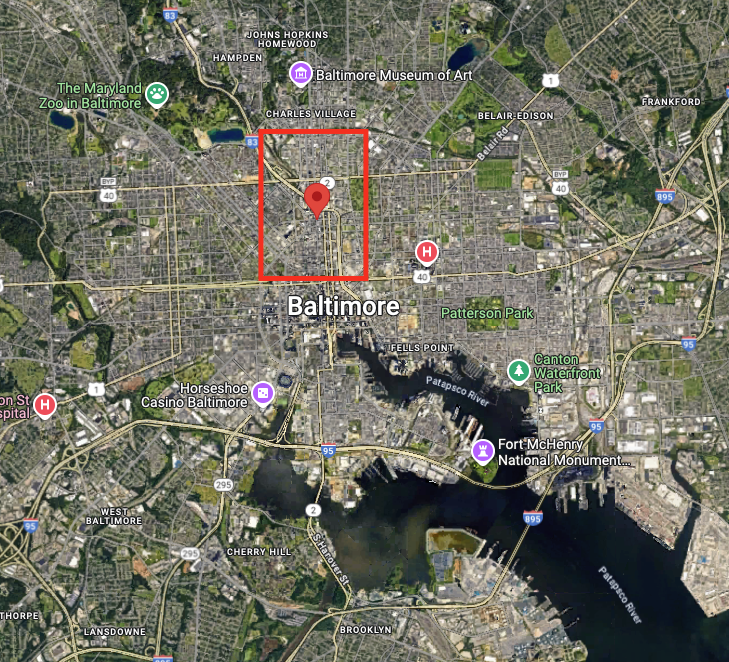

- Prime Locations: Strategically situated in Downtown Baltimore, centered around major employers and transit hubs. 🗺️

- Growth Potential: Baltimore’s appreciating market and robust rental demand make this a smart long-term investment. 🚀

Why Invest in Baltimore?

Baltimore’s real estate market is a hidden gem for savvy investors:

- Strategic Location: Positioned along the I-95 corridor with proximity to Washington, D.C., BWI Airport ✈️, and the Port of Baltimore 🚢.

- Economic Powerhouse: Anchored by world-class “Eds and Meds” institutions like Johns Hopkins University, University of Maryland Medical Center, and more, driving steady job growth and renter demand. 🎓🏥

- High Rental Demand: Affordable home prices and rising homeownership costs fuel a thriving rental market with low vacancy rates and steady rent growth. 📈

Don’t Miss Out!

This is a limited opportunity to acquire a diversified, income-producing portfolio in one of the East Coast’s most promising markets. With strong fundamentals and room for value-add strategies, this portfolio is perfect for investors seeking immediate returns and long-term wealth creation.

📞 Contact Us Today to schedule a viewing or request the full financial package!

👉 Act Fast – Opportunities like this don’t last long in Baltimore’s hot market!